Explore

Our Insights

Featured insights on today’s biggest business challenges and solutions.

Tax Insights

YET ANOTHER SUPREME COURT INCOME TAX CASE! – THE COURT TAKES ON THE “MANDATORY REPATRIATION TAX”

January 02, 2024 - Learn about latest in tax law with insights from Paul Bercovici, Director of International Tax at Adeptus. Paul covers a surprising Supreme Court income tax case in the latest Taxes and Wealth Management Newsletter by Thomas Reuters.

Read More

Maximizing Financial Success: Prepare for September 15 and October 15 Tax Deadlines with Adeptus

August 01, 2023 -

Read More

Navigating Tax Administrative Red Tape: The Vital Role of Tax Controversy Professionals

August 01, 2023 - Whether you are facing an income tax audit, disputing an adverse determination, dealing with a criminal investigation, or trying to determine how to pay a tax liability, a tax controversy professional can make the experience less daunting and increase your chances for a more favorable outcome.

Read More

How Adeptus Can Support Your Cannabis Business

July 07, 2023 - As more and more states legalize medical and recreational cannabis, limitations and confusing tax laws continue to disrupt the emerging field. As a result, Cannabis Operators need to consider state and federal regulations and complex tax obligations, including the 280E adjustment.

Read More

Adeptus Partners Announces Administrative Leadership Roles

May 17, 2023 - To accommodate the growing needs of the firm, Adeptus Partners names Larry Gitlitz and Deana Mullaney as new leadership to oversee the Administrative Operations of the firm.

Read More

IRS Lacks Statutory Authority to Assess Penalties Under Section 6038(b) for Willful Failure to File Form 5471

April 07, 2023 - After the US Tax Court ruled in favor of a taxpayer over filing under section 6038(b), tax payers who have faced similar penalties may be eligible for a refund.

Read More

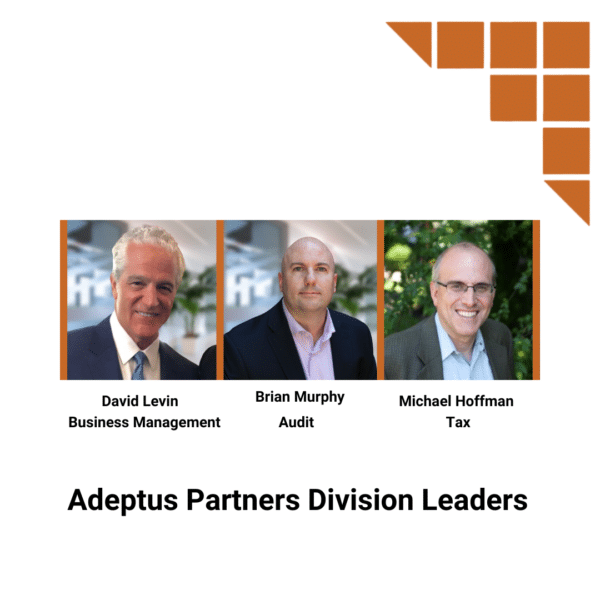

Adeptus Partners Announces Division Leaders to Accommodate Agency Growth

March 27, 2023 - Howard Krant, CEO and Managing/Founding Partner of Adeptus Partners, leads a strong team of top talent to meet the growing needs of our accounting and advisory firm.

Read More

Tax Information for NIL Athletes

March 10, 2023 - Adeptus Partners' Jennifer Coyne joined MOGL to educate college athletes on monetizing their personal brands through NIL deals & what that means for tax season.

Read More

Adeptus Partners, LLC Expands Global Reach through IAPA International

January 10, 2023 - Leading accounting, advisory, and business management firm joins IAPA International to meet the growing needs of international business.

Read More

Adeptus Partners Forms Strategic Partnership with Sands Lane to Build Emerging Markets Practice

December 15, 2022 - Adeptus forms strategic partnership with Sands Lane to build Emerging Markets Practice, further enhancing focus on the cannabis, psychedelics, and web3 categories.

Read More

Navigating NY Cannabis Regulations

October 13, 2022 - Adeptus Solutions Cannabis Advisors can help you navigate the New York cannabis licensure requirements, promoting compliance with the NY Office of Cannabis Management.

Read More

Managing Cyclical Income In Sports And Entertainment

September 22, 2022 - The business life of professional entertainers and athletes is cyclical, so we have tailored accounting services specific to our performing clients – actors, models, musicians, and athletes. We know your business and how to serve you.

Read More

What Influencers Need to Know When Doing Their Taxes

June 17, 2022 - The influencer marketing industry is estimated to reach $16.4B in 2022, and influencers need to have a proper tax preparation strategy in place.

Read More

What’s the Difference Between a 1099 Contractor and a W2 Employee?

March 15, 2022 - Understanding the distinction now can save you in the long run. Whether you’re an established business or a budding startup, one thing for certain is, running a business isn’t always as straightforward as you might think. Especially...

Read More

When Do I Need Professional Tax and Advisory Services?

January 15, 2022 - Tax Season Preparation: Know when you should look for support in putting together your accounting records and financial statements

Read More

5 Tax Planning Tips for the New Year

December 15, 2021 - Start the new year off on the right foot by having your tax strategy in place As the end of the year nears, your thoughts are probably shifting to the holidays, spending quality time with loved ones,...

Read More

What Are the Latest Trends in Tax Law?

November 15, 2021 - Understanding the latest tax trends will help you make the right decisions in your planning. Although we’re more than a year past the disruptions of COVID-19, 2021 continues to reverberate with its effects. For instance, in a...

Read More

End of Year Tax Planning Guide

October 15, 2021 - Follow this guide to ensure that you are optimizing your tax benefits. Who doesn’t like to be prepared? The adage, “The early bird gets the worm” rings true in all aspects of life – taxes included. We...

Read More