Explore

Our Insights

Featured insights on today’s biggest business challenges and solutions.

Accounting Insights

YET ANOTHER SUPREME COURT INCOME TAX CASE! – THE COURT TAKES ON THE “MANDATORY REPATRIATION TAX”

January 02, 2024 - Learn about latest in tax law with insights from Paul Bercovici, Director of International Tax at Adeptus. Paul covers a surprising Supreme Court income tax case in the latest Taxes and Wealth Management Newsletter by Thomas Reuters.

Read More

New Beneficial Ownership Information Reporting is Coming – Are You Ready?

October 18, 2023 - In a further effort to combat money laundering, tax fraud, terrorism financing, drug and human trafficking and other criminal enterprises, in January 2021 the US Congress enacted the Corporate Transparency Act (“CTA”).

Read More

Navigating Tax Administrative Red Tape: The Vital Role of Tax Controversy Professionals

August 01, 2023 - Whether you are facing an income tax audit, disputing an adverse determination, dealing with a criminal investigation, or trying to determine how to pay a tax liability, a tax controversy professional can make the experience less daunting and increase your chances for a more favorable outcome.

Read More

How Adeptus Can Support Your Cannabis Business

July 07, 2023 - As more and more states legalize medical and recreational cannabis, limitations and confusing tax laws continue to disrupt the emerging field. As a result, Cannabis Operators need to consider state and federal regulations and complex tax obligations, including the 280E adjustment.

Read More

Adeptus Partners Announces Administrative Leadership Roles

May 17, 2023 - To accommodate the growing needs of the firm, Adeptus Partners names Larry Gitlitz and Deana Mullaney as new leadership to oversee the Administrative Operations of the firm.

Read More

IRS Lacks Statutory Authority to Assess Penalties Under Section 6038(b) for Willful Failure to File Form 5471

April 07, 2023 - After the US Tax Court ruled in favor of a taxpayer over filing under section 6038(b), tax payers who have faced similar penalties may be eligible for a refund.

Read More

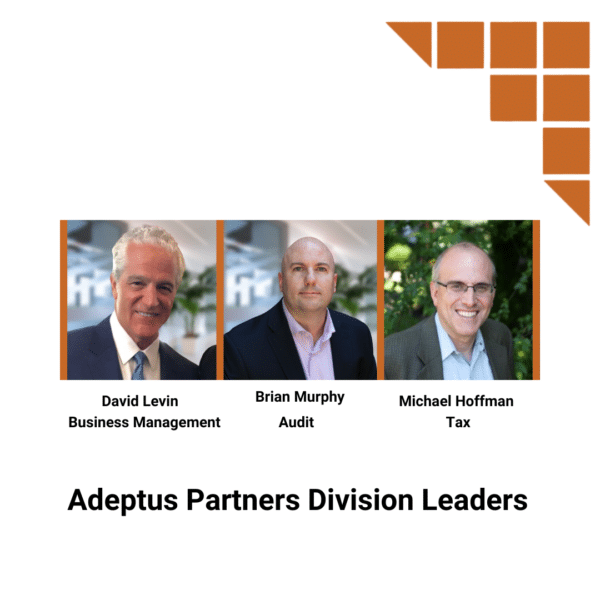

Adeptus Partners Announces Division Leaders to Accommodate Agency Growth

March 27, 2023 - Howard Krant, CEO and Managing/Founding Partner of Adeptus Partners, leads a strong team of top talent to meet the growing needs of our accounting and advisory firm.

Read More

Adeptus Partners, LLC Expands Global Reach through IAPA International

January 10, 2023 - Leading accounting, advisory, and business management firm joins IAPA International to meet the growing needs of international business.

Read More

Adeptus Partners Forms Strategic Partnership with Sands Lane to Build Emerging Markets Practice

December 15, 2022 - Adeptus forms strategic partnership with Sands Lane to build Emerging Markets Practice, further enhancing focus on the cannabis, psychedelics, and web3 categories.

Read More

Navigating NY Cannabis Regulations

October 13, 2022 - Adeptus Solutions Cannabis Advisors can help you navigate the New York cannabis licensure requirements, promoting compliance with the NY Office of Cannabis Management.

Read More

What Influencers Need to Know When Doing Their Taxes

June 17, 2022 - The influencer marketing industry is estimated to reach $16.4B in 2022, and influencers need to have a proper tax preparation strategy in place.

Read More

What’s the Difference Between a 1099 Contractor and a W2 Employee?

March 15, 2022 - Understanding the distinction now can save you in the long run. Whether you’re an established business or a budding startup, one thing for certain is, running a business isn’t always as straightforward as you might think. Especially...

Read More

What Are the Latest Trends in Accounting?

February 15, 2022 - Accounting policies and best practices are constantly changing with technological advancements, stay ahead to promote business growth and resiliency. Switching to a Remote Workforce The recent pandemic shifted the way the workforce conducted business. Many businesses were...

Read More